“The details of the coverage matter!”

Dwelling: What’s most important is that you carry sufficient dwelling coverage. If you don’t, and you have a loss, the insurance company will pay you a percent of the coverage you should have carried. For example, you carry $200,000 in dwelling coverage and should have carried $400,000 and have a loss for $100,000. The insurance company will hand you a check for $50,000 since you carried 50% of the coverage you should have.

Click here for more information on how you can be penalized for not carrying enough coverage: How does coinsurance work in a commercial property insurance policy? | Anderson Insurance Group

Ordinance & Law: Pays to bring the undamaged portion of a property to code in case of a covered loss. The older the property, the more critical it is to have O & L.

Loss of Rental Income: Some rental properties will take 18 months to rebuild, and some are high-grossing properties. It's important to know how much coverage you have for loss of rent.

Liability: There are two important factors when discussing liability coverage: 1) It only costs an additional $20.00 per year to increase your coverage from the base of $100,000 to $300,000 or even $500,000. And 2) It's essential that you require your tenants to carry renters insurance. Click here for more information: Are You Requiring Renters Insurance? | Anderson Insurance Group

Special Form Coverage: Is the broadest dwelling coverage available almost all rental properties in Utah will be eligible for Special Form coverage, also referred to as a DP-3 form. Don’t settle for less than DP-3/Special Form unless you have to because of the age, location, type or claims history of the property.

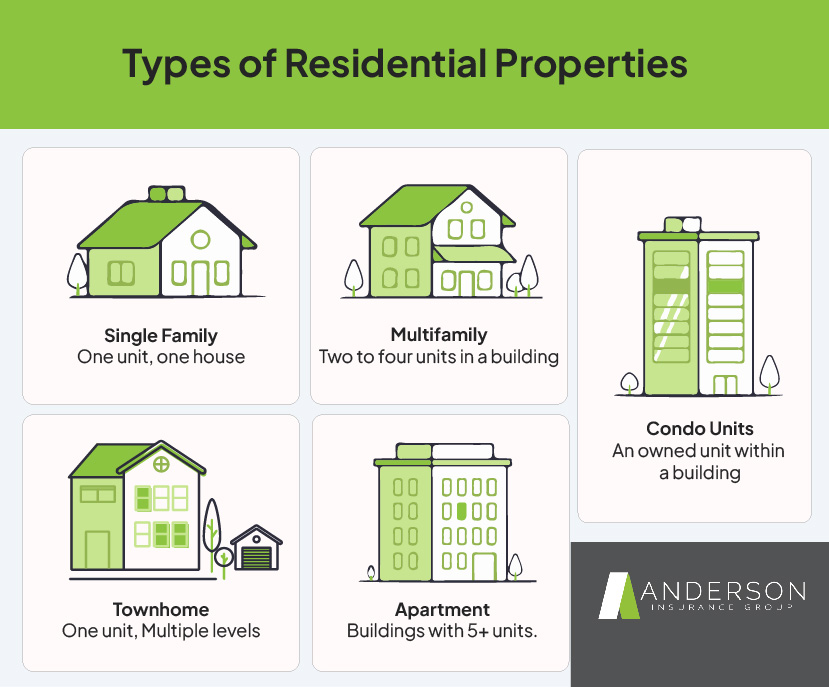

Five Types of Landlord Risks

Single Family Rental Homes

Multi-family homes (duplexes – fourplexes)

Rental Condos

Rental Townhomes

Apartment Buildings Essential Insurance Coverage for Apartment Buildings in Salt Lake City, UT

Five things you can do to better protect yourself as a landlord:

Additional coverage you can add to give yourself the best protection:

Service Line Insurance: covers repairs or replacements of main water and sewer lines, preventing you from facing unexpected out-of-pocket expenses. Service Line Coverage - The Hottest Topic Between Plumbers & Utah Insurance Agents | Anderson Insurance Group This coverage is not offered on every policy. If not available on your policy, you can purchase the coverage through Dominion Energy’s HomeServe program: Dominion Energy | HomeServe

Personal Injury – Will protect you against accusations of discrimination or wrongful evictions and is very inexpensive.

Contents Coverage – Coverage for your appliances and any other removable items you keep on the property.

Loss Assessments – May be necessary if your rental property is part of a homeowners association.

Request a quote and protect your Property today!

Three promises if you buy landlords insurance from an online company:

You will be underinsured.

Many online insurance policies allow landlords to choose their coverage limits without proper guidance. As a result, you may unknowingly select an amount that leaves you underinsured and vulnerable in the event of a claim.

Missing coverage.

These online systems are also programmed to prompt you to select lower limits or not add necessary coverage because again, the advantage to the “insuretech” you get a cheap price and, they don’t have to cover stuff!

You will overpay.

That’s correct; the prices from these online-only companies are not competitive. And, if you do pay cheaper now, you will pay when you have a claim. Insurance is like anything, you will either pay now or pay later, either way, cutting corners with insurance coverage does not save that much and is never a good idea.

Trust Anderson Insurance Group

Don’t leave your home at risk with incomplete coverage. Contact us today for a personalized, no-obligation quote.