Record inflation and losses have wreaked havoc on the property insurance sector, causing increases of more than 20% in 2023 with more increases in 2024 and beyond.

Now, more than ever, reviewing your insurance coverage and ensuring your properties are sufficiently insured is essential. Why? With record-high inflation, it’s easy to find yourself underinsured. If your property is underinsured by more than 20%, that can trigger the traditional 80% coinsurance clause, netting you pennies on the dollar in the event of even a partial loss.

This article will emphasize how important it is to insure your commercial building and property to its full replacement cost. When insuring a property, independent insurance agents will perform a cost estimate using current technology, which is very fast and accurate.

The independent insurance agent will select a coinsurance percentage between 80%, 90%, and 100%. Consider the 80% coinsurance as a 20% buffer for the current property coverage in case of a claim. As long as the total amount of the property replacement at the time of loss is within 20% of the insured amount (as indicated on the declarations page), no coinsurance penalty will be applied. The coinsurance clause is applied to partial losses as well.

Here are a few coinsurance scenarios and what you can expect as part of the claims process. This information can also be found on the Travelers Insurance website: Calculating Coinsurance | Travelers Insurance

Here is what you can expect from your claim professional if your policy includes a coinsurance clause. They will:

- Determine the applicable limit of insurance

- Determine the value of the lost or damaged property (e.g., your building) at the time of the loss

- Apply the coinsurance percentage to the value of the property

- Determine whether the limit of insurance equals or exceeds that amount

- Explain to you how an unmet coinsurance requirement will affect your claim payment

This is the formula for determining whether the amount of insurance you have purchased (the limit of insurance) meets your coinsurance requirement:

Value of the property x Coinsurance percentage = Minimum insurance amount required

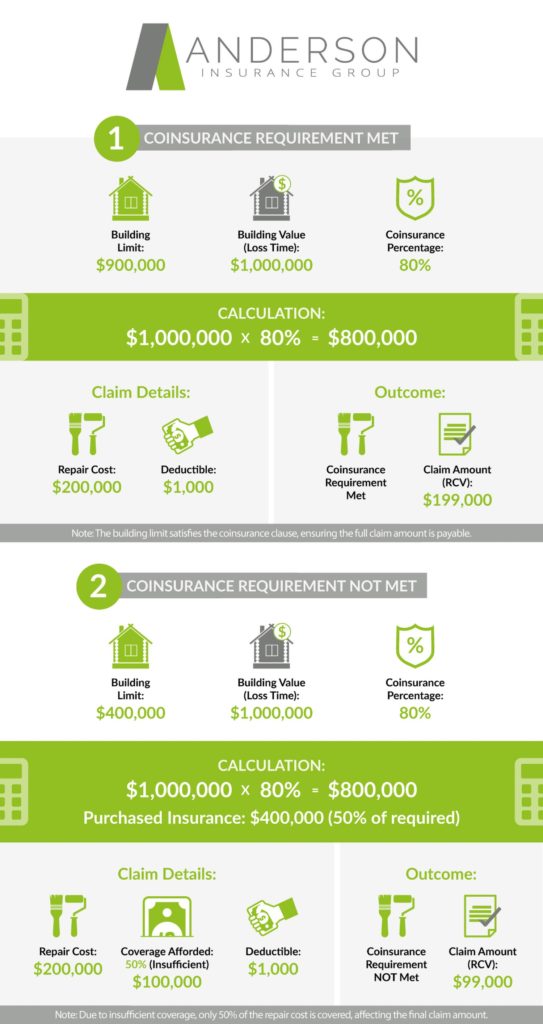

Here are two examples of how coinsurance works based on a replacement cost value basis.

Scenario 1: Coinsurance requirement is satisfied:

The building limit is $900,000

The value of the building at the time of the loss is $1,000,000

The coinsurance percentage is 80%

The limit of insurance should be at least $1,000,000 x 80% = $800,000

Because the building limit meets the minimum amount of insurance required under the coinsurance clause, the amount due on a claim is not affected:

The cost to repair the covered damage is $200,000

The deductible is $1000

The amount payable based on Replacement Cost Value (RCV) is $199,000.

This amount represents 100% of the cost to repair the covered damage minus the deductible.

Scenario 2: Coinsurance requirement is not satisfied:

The building limit is only $400,000

The value of the building at the time of loss is $1,000,000

The coinsurance percentage is 80%

The limit of insurance should be at least $1,000,000 x 80% = $800,000

Because the amount of insurance purchased is only 50% of the amount required ($400,000/$800,000), coverage is afforded for only 50% of the repair cost:

The cost to repair the covered damage is $200,000

50% of the repair cost is 200,000 x .50 is $100,000

The deductible is $1000

The amount payable based on RCV is $99,000.

For a full review of your apartment or rental property insurance, contact a knowledgeable Anderson Insurance Group agent today.

Are You Requiring Renters Insurance? | Anderson Insurance Group