Protecting Your Home the Right Way

The best homeowners insurance in Riverton can be found at Anderson Insurance Group, because protecting your home isn’t just about finding the lowest price.

Homeowners insurance should never be treated like a commodity. When price is the only focus, coverage is often stripped down, leaving homeowners underinsured when they need protection the most. Our approach is different. We focus on the details of your policy to make sure your Riverton home is fully protected, not just “technically insured.”

Below are some of the most important elements of homeowners insurance that many companies and agents overlook.

Core Homeowners Insurance Coverages

Dwelling / Structure Coverage

The cost to rebuild homes in Riverton has increased significantly over the past several years due to:

- Inflation

- A shortage of skilled labor

- Increased weather activity

These factors have driven replacement costs higher across Utah. Many homeowners are unknowingly underinsured. We strongly recommend a current review of your dwelling limits to ensure your home is insured to its true rebuild cost, not its market value.

Extended Replacement Cost (ERC)

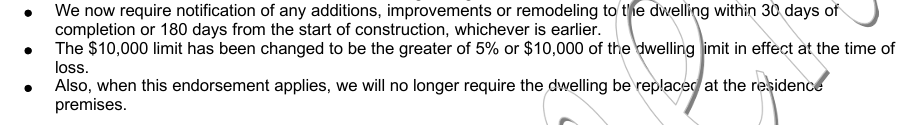

Extended Replacement Cost coverage is one of the most important protections against being underinsured. This endorsement can increase your dwelling coverage by 125%, 150%, 200%, or even provide Guaranteed Replacement Cost.

For ERC to apply correctly:

- Your home’s square footage must be accurate

- Finished basements and renovations must be disclosed

- Improvements must be updated on the policy

If this information is incorrect, the endorsement can be voided, and in some cases, a co-insurance penalty may apply. If you have finished your basement or made other improvements, be sure to notify your agent.

A representative from a large online insurer recently told us:

“We give people what they ask for, not what they need.”

Do not risk underinsuring your home. This is a common issue with online insurance companies that compete on price. The savings disappear quickly when a claim isn’t fully covered. Riverton homeowners deserve better.

Navigating Online Insurtechs: Innovations, Risks, and Pitfalls | Anderson Insurance Group

Contents (Personal Property) Coverage

Your policy covers more than just your house, it covers what’s inside it. Furniture, clothing, electronics, and personal belongings are all included, but most policies place limits on:

- Jewelry

- Business tools

- Firearms

- Collectibles

If you own higher-value items or tools used for work, additional endorsements may be necessary.

Additional Living Expense (ALE)

If your Riverton home becomes unlivable after a covered loss, ALE pays for temporary housing, meals, and related expenses while repairs are made.

Rebuilding takes longer than ever. Inadequate ALE coverage can leave homeowners paying out of pocket during an already stressful time.

Personal Liability

Personal liability coverage protects you if someone is injured on your property and you are found legally responsible. Common claims include:

- Trip and fall injuries

- Dog bites

Many insurance companies limit or exclude coverage for certain dog breeds. If you own a dog, especially a restricted breed, it’s critical to review your liability coverage carefully.

What Truly Makes the Best Homeowners Insurance in Riverton

Basic coverage isn’t enough. The best homeowners insurance policies go deeper.

Service Line Protection

Service Line coverage pays to repair or replace underground water or sewer lines running from your home to the street. These repairs can easily cost thousands of dollars.

Not all companies offer this coverage, and eligibility may depend on the age of your Riverton home. If it’s not available on your policy, it can sometimes be added through utility providers.

Water Seepage & Leakage Coverage

This endorsement covers hidden water damage caused by slow leaks, often behind walls or cabinets, that develop over time.

Most standard policies exclude this type of loss. Adding this coverage removes uncertainty about whether water damage is considered “sudden and accidental.” Typical limits start around $10,000, with higher options available.

Ordinance & Law Coverage

Building codes change over time. Ordinance & Law coverage pays to upgrade undamaged portions of your home to current code following a covered loss.

Example:

If part of your Riverton home is damaged by fire, local building codes may require updates to electrical, plumbing, or structural systems throughout the house, not just the damaged area. Without Ordinance & Law coverage, those costs come out of pocket.

Sprinkler & Exterior Water Pipe Damage

Utah homes are unique, many have:

- Finished basements

- Irrigation systems

If an irrigation line breaks and water floods your basement, many policies do not cover this loss unless the policy specifically includes this protection. Riverton homeowners with basements should always confirm this coverage.

Inland Flood Coverage

Inland Flood is a broader, more affordable alternative to traditional flood insurance. It can be added directly to your homeowners policy and often includes basement coverage, something standard flood insurance typically excludes.

With Utah experiencing more sudden, intense storms, Inland Flood has become an increasingly valuable coverage option.

Water & Sewer Backup

Water and sewer backup losses usually occur on your property, meaning coverage limits are less important than simply having the coverage in place.

A basic limit should always be included to protect against sewage or drain backups that can cause extensive interior damage.

The Best Homeowners Insurance in Riverton

The best homeowners insurance isn’t defined by the lowest premium or just high dwelling limits. It’s defined by comprehensive protection, thoughtful coverage design, and working with an agency that understands Riverton homes and Utah-specific risks.

At Anderson Insurance Group, we take the time to ensure your homeowners policy is built to protect you, not just sell you a price.

If you want homeowners insurance in Riverton done right, let’s review your coverage together.

Here are a few more links with additional information to help you get the best homeowners insurance coverage:

Homeowners & Condo Insurance | Anderson Insurance Group

Earthquake Insurance in Utah | Anderson Insurance Group

Roofing Scams – Hail No! | Anderson Insurance Group

Second Home Insurance | Anderson Insurance Group

Anderson Insurance Group – West Valley City – Utah