Handyman Liability Insurance

Protect your business with fast, reliable service from a knowledgeable Utah commercial insurance agent—experience the difference with Anderson Insurance Group!

Coverage Handymen Need

As a handyman, you most often work on people’s most valuable and cherished possession: their homes. Gain peace of mind knowing you're covered for any accidental damage you might cause to a client’s home or property with handyman insurance from Anderson Insurance Group.

Workers’ Compensation

Tools & Equipment

General Liability

Commercial Property/Installation Floater

Voluntary Property Damage

Contractors E & O

Save up to 25% today on handyman insurance with Anderson Insurance

You can pay for your insurance monthly or annually and you can cancel instantly at any time.

BASIC PACKAGE:

$500.00 yr/$47.45 Month

Get your license and get to work.

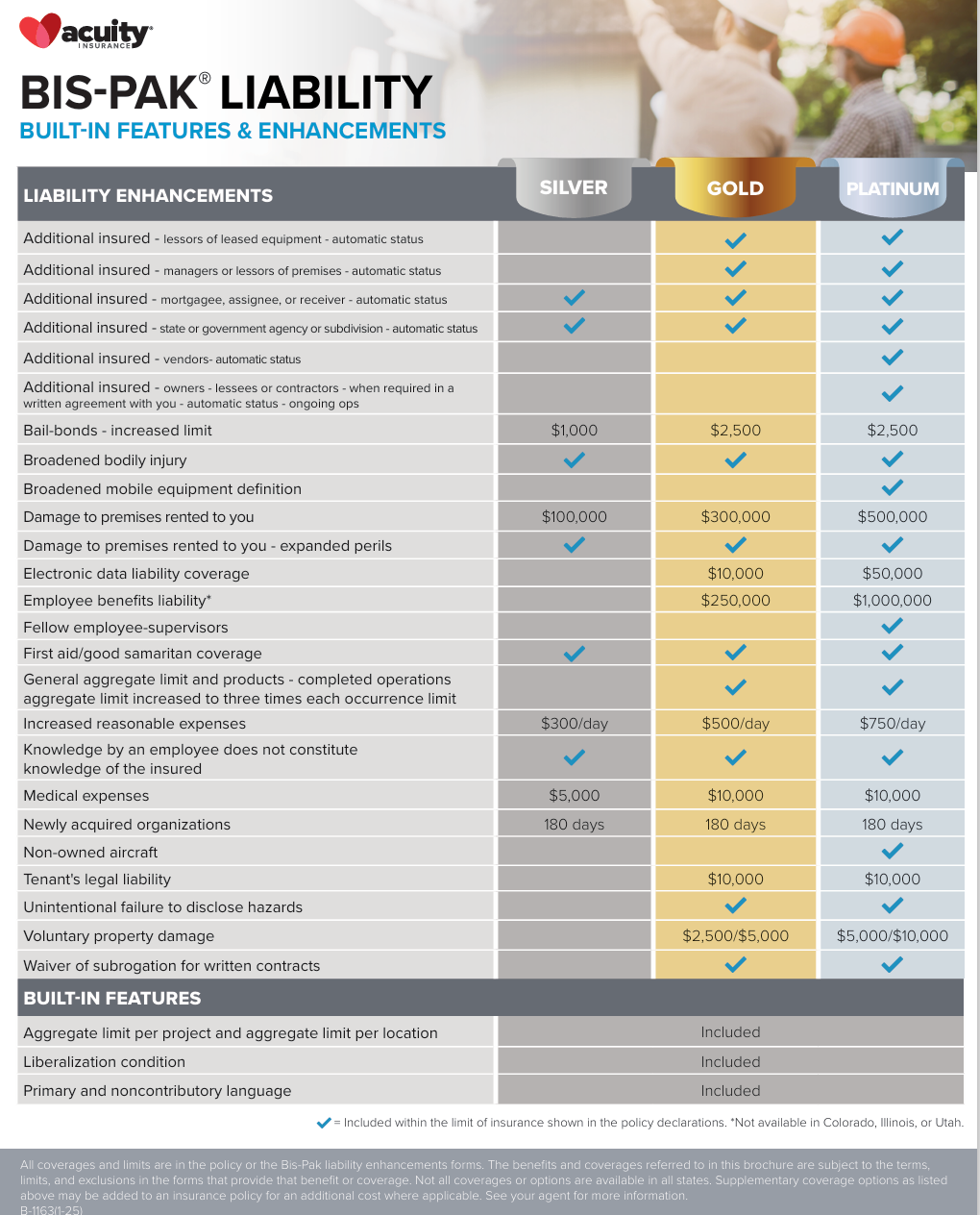

Silver Enhancements

GOLD PACKAGE:

$678.00 yr/63.64 Month

Most Popular: Certificates/Tools/High Limits

Gold Enhancements

PLATINUM PACKAGE:

$989.00 yr/$91.91 Month

Certificates/Tools/High Limits

Platinum Enhancements

*** All Pricing includes a $500.00 Property Damage Deductible and based on a 1-person handyman business with no use of subcontractors

Anderson Insurance Group offers Handyman Insurance Coverage through: Acuity Insurance, Auto-Owners, Cincinnati Insurance, and United Insurance Group.

Essential Insurance Coverage for Handymen and Independent Contractors

Get the right protection for your handyman business with comprehensive insurance coverage tailored to your needs. Anderson Insurance Group offers affordable policies that safeguard your work, equipment, and reputation.

Workers’ Compensation

Workers’ Compensation insurance is required if you have employees and will help pay for injuries that may occur on the jobsite. Workers’ Compensation | Anderson Insurance Group

Tools & Equipment

Are your tools properly insured? Make sure your job security is backed by comprehensive coverage from Anderson Insurance Group.

General liability

General liability insurance is an important coverage for handymen providing financial protection in two key areas:

Bodily Injury to Third Parties (non-employees): If a client or a visitor to your worksite gets injured due to your operations, general liability can cover their medical expenses, legal fees, and potential settlements. For example, if a client trips over your toolbox and breaks their arm.

Property Damage to Third Parties: This covers damage you accidentally cause to property that doesn't belong to you. For instance, if you're installing a shelf and accidentally put a hole in the client's wall.

Commercial Property/Installation Floater

If you need to protect building materials at your place or, at the property of a client, ask how to inexpensively protect them.

Contractors E & O

Contractors E & O Coverage against business mistakes and claims of negligence What is Contractor's Errors & Omissions Insurance | Anderson Insurance Group

General Liability coverage in a commercial insurance policy is broad coverage but will exclude coverage for “your work”. GL or CGL will not cover mistakes that you may make as a contractor and that is where Contractor’s E & O coverage comes into play.

Voluntary Property Damage

Voluntary Property Damage provides coverage for unintentional damage to the real property of others while that property is under your Care, Custody, or Control. What is Voluntary Property Damage Coverage? | Anderson Insurance Group

Why is handyman insurance important:

Licensing Requirements: Utah requires you to have general liability insurance for your handyman license. Anderson Insurance Group, can provide the necessary proof of insurance to DOPL, the Utah Department of Professional Licensing so you can start to work: Handyman License & Insurance Requirements | Anderson Insurance Group

Client Expectations: It's very common for clients, especially those with larger projects or commercial clients, to ask for proof of insurance. They want to ensure that they won't be held financially responsible if something goes wrong. Having proof of insurance can help you win bids and build trust with potential clients.

Financial Protection: Without general liability insurance, a single accident or mistake could lead to significant out-of-pocket expenses for medical bills, property repairs, or legal defense costs, jeopardizing your business.