Utah Window Cleaning Liability Insurance

Our customized insurance for window cleaning professionals gives you the protection to work with confidence whether you handle residential properties in Salt Lake City or manage large-scale commercial projects across the Wasatch Front.

What Insurance Coverage Do Window Cleaning Businesses Need?

Our insurance plans are flexible, scalable, and tailored to fit your operation, whether you’re a one-person window washer or manage multiple teams serving commercial clients.

General Liability

Workers' Compensation

Equipment & Tools

Contractors E & O - Errors and Omissions

Voluntary Property Damage

Commercial Auto

Flexible Insurance Plans

Pay monthly, annually and cancel at any time.

BASIC PACKAGE:

$450.00 yr/$43.51 Month

Get your license and get to work.

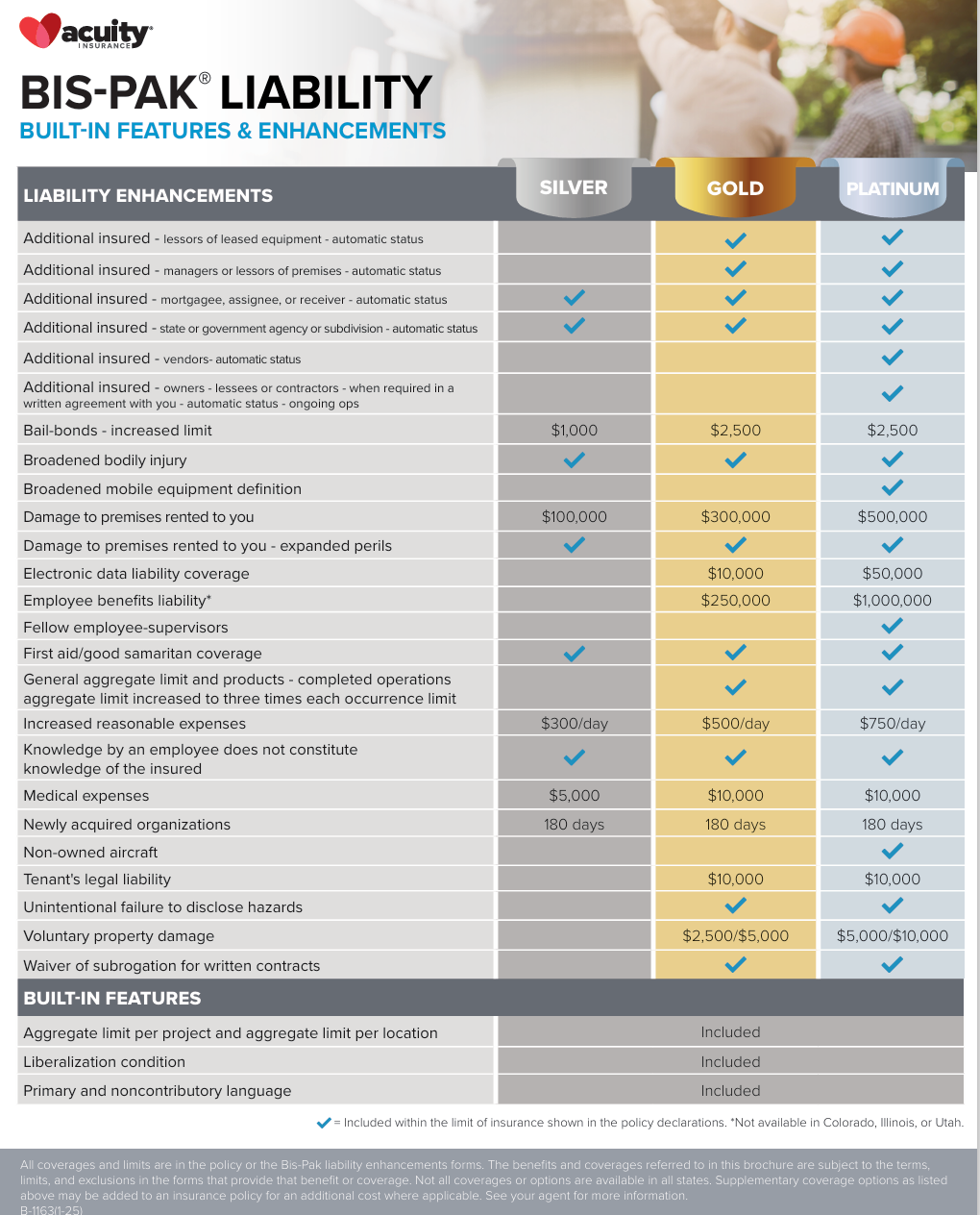

Silver Enhancements

GOLD PACKAGE:

$575.00 yr/54.91 Month

Most Popular: Certificates/Tools/High Limits

Gold Enhancements

*** Estimated pricing varies based on location, number of employees, and claims history.

Anderson Insurance Group offers window cleaning business insurance coverage through: Acuity Insurance, Auto-Owners, Cincinnati Insurance, WCF and United Insurance Group.

Core Coverages for Window Washing Contractors

General Liability Insurance for Window Cleaning Contractors

General liability safeguards your business if a third party suffers bodily injury or property damage while you’re on the job. For example, if a pedestrian slips on soapy water or a ladder damages siding or landscaping, this policy pays for medical bills, repairs, and legal defense. Many Utah municipalities and commercial property owners require proof of coverage before awarding contracts making this insurance essential.

Workers’ Compensation

Window cleaning involves working on ladders, rooftops, and chemical cleaning solutions, all of which increase the risk of accidents and injuries. Workers’ compensation pays for medical treatment, rehabilitation, and a portion of lost wages if an employee suffers a fall, strain, or chemical exposure on the job. Carrying this coverage also protects your business from expensive employee injury lawsuits. Work Comp Waiver in Utah | Anderson Insurance Group

Equipment & Tools Coverage

Your gear is essential to your work. This insurance covers your ladders, squeegees, extension poles, and safety harnesses against theft, accidental breakage, or fire damage—both on the job and while in transit. Without this coverage, replacing specialized tools could mean costly downtime and lost income.

Contractors Errors & Omissions

This coverage protects you if a client claims your service was incomplete or performed incorrectly. For example, if streaks or residue cause a dispute or you miss scheduled windows for a commercial property and the client alleges financial loss, E&O helps cover legal defense, settlements, and related costs. It’s an extra layer of protection for Utah window cleaning businesses that service high-value or corporate accounts. What is Contractor's Errors & Omissions Insurance | Anderson Insurance Group

Voluntary Property Damage

Even careful professionals can have accidents. If you crack a windowpane, scratch decorative glass, or damage a wooden frame, this coverage steps in where general liability stops. It pays for repairs or replacement and helps maintain your reputation with high-end clients who expect nothing less than perfection.. What is Voluntary Property Damage Coverage? | Anderson Insurance Group

Commercial Auto Insurance

Covers your van or commercial vehicle that transports equipment, ladders, and cleaning supplies. Commercial auto insurance protects company vehicles and drivers against collisions, theft, vandalism, and liability claims.

Why Choose Anderson Insurance Group

Why Your Utah Window Cleaning Business Needs Insurance

Financial Protection: A single accident, such as a fall from a ladder or a shattered storefront window, can result in significant medical expenses or legal claims. Insurance transfers these risks to the carrier so you don’t pay out of pocket.

Licensing & Contract Compliance: Most commercial clients and municipalities in Utah require window cleaners to show proof of liability and workers’ comp insurance before approving any project especially for multi-story buildings.