Utah Roofers Insurance – Protection for Your Projects and Team

Protect your roofing business with tailored insurance coverage in Utah.

Coverage Roofers Need

As a roofing contractor, you work high above some of your clients’ most valuable investments—their homes and businesses. From slip-and-fall risks to property damage caused during installation or repairs, roofing involves unique hazards. Ensure your business is fully shielded with a customized roofing contractor insurance plan from Anderson Insurance Group—your trusted partner for contractor coverage in Utah.

Tools and Equipment

Workers' Compensation

General Liability

Contractors’ E&O - Errors and Omissions Insurance

Commercial Auto

You can save up to 25% in discounts on Roofers insurance

You can pay for your insurance monthly or annually and you can cancel instantly at any time.

BASIC PACKAGE:

Get your license and get to work.

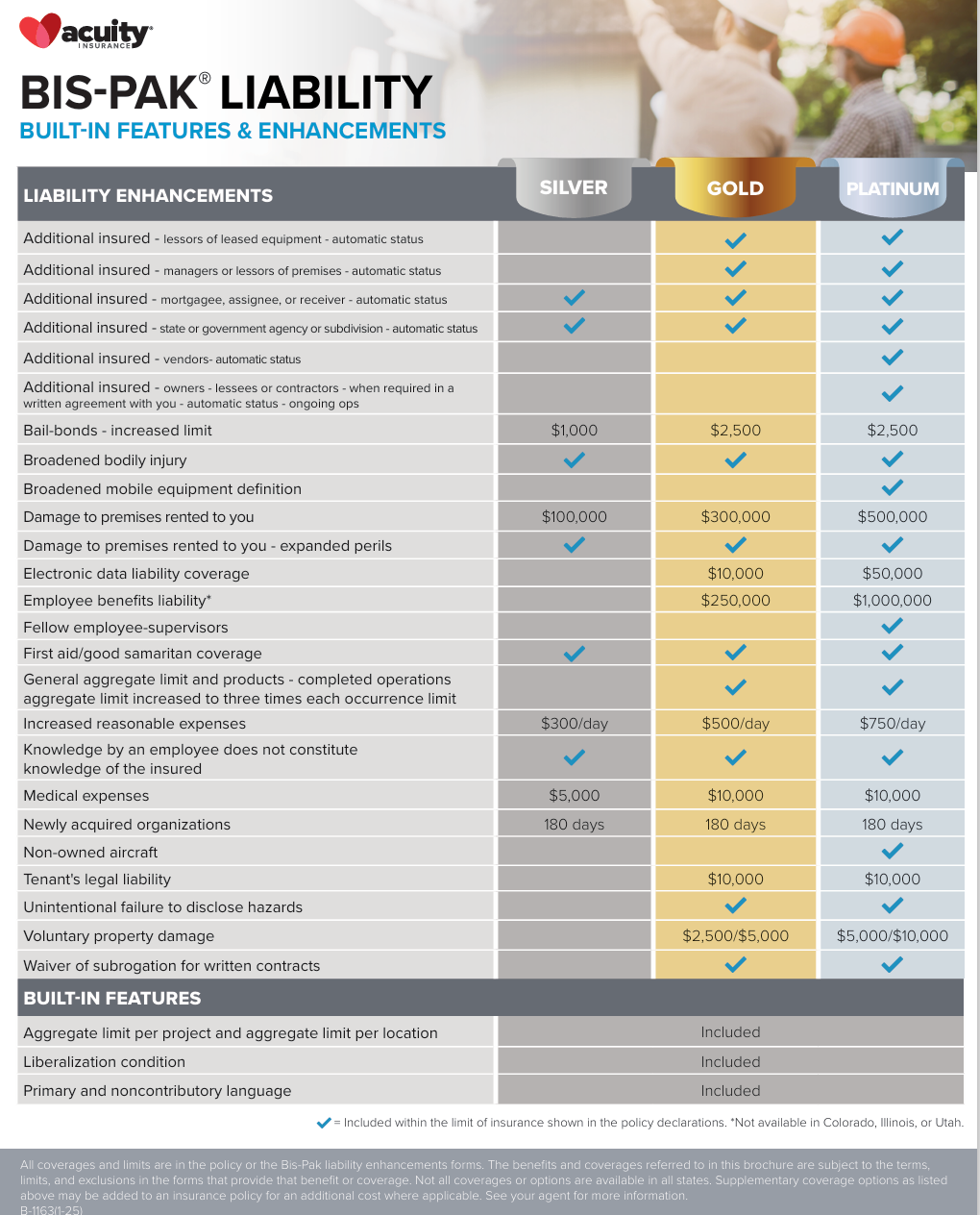

Silver Enhancements

GOLD PACKAGE:

Most Popular: Certificates/Tools/High Limits

Gold Enhancements

PLATINUM PACKAGE:

Certificates/Tools/High Limits

Platinum Enhancements

Anderson Insurance Group offers Roofers Insurance Coverage through: Acuity Insurance, Auto-Owners, Cincinnati Insurance, and United Insurance Group.

Core Coverages for Roofing Contractors

Workers' Compensation

Workers' compensation helps pay for worker injuries on the job and rehabilitation to get them back on the job as soon as possible. Work comp for roofers assures your clients that if an injury occures on their premises, your coverage will respond. Workers’ Compensation | Anderson Insurance Group

Tools & Equipment Insurance

Protect your valuable tools and equipment wherever you go with this coverage. From on-site accidents to theft while transporting tools, our insurance ensures your gear is protected so you can focus on the job at hand without worry.

Errors & Omissions (E&O)

Provides your roofing business with vital protection against claims of professional mistakes, installation errors, design flaws, or negligence that could result in legal disputes and financial loss. Ideal for preventing expensive disputes, preserving your reputation, and ensuring customer trust in every roofing project. What is Contractor's Errors & Omissions Insurance | Anderson Insurance Group

More coverage beyond GL: E&O protects against mistakes such as improper installation or leakage claims later on.

General Liability Insurance for Roofers

This essential coverage protects your business from accidents and property damage that may occur on the job. Whether it's an injury to a client, third party or damage to their property, general liability insurance helps protect your company from financial loss and legal action.

Commercial Auto Insurance

If your roofing business involves transporting tools and equipment to job sites, commercial auto insurance is a must. This coverage protects your vehicles and drivers in case of accidents, theft, or damage, ensuring your business can continue operating smoothly. Commercial Auto Insurance | Anderson Insurance Group

Why Roofing Contractor Insurance Matters

Licensing & Contracts: Many Utah municipalities or commercial clients require proof of general liability and workers’ compensation before awarding roofing contracts.

Client Expectations: Residential and commercial customers expect comprehensive coverage that safeguards them from property damage, personal injury, and unforeseen incidents during roofing operations.

Financial Security: Roofing work involves high risk—one accident or claim without proper coverage can lead to significant out-of-pocket losses.