Insurance for Window Cleaning Contractors in Utah

At Anderson Insurance Group, we understand the unique challenges of working at heights, managing equipment, and meeting client expectations. Our window cleaning insurance provides full protection so you can take on every job with confidence—from residential homes in Salt Lake City to high-rise office buildings throughout the Wasatch Front.

What Insurance Coverage do Window Cleaning Businesses Need?

Our policies are flexible and scalable, so you can tailor coverage to the size of your company and the types of projects you handle from single-operator window washers to multi-crew commercial contractors.

General Liability

Equipment & Tools

Voluntary Property Damage

Contractors E & O - Errors and Omissions

Workers' Compensation

Commercial Auto

Flexible Insurance Plans

At Anderson Insurance, we make it simple to get protected—pay monthly or annually, adjust your coverage anytime, and cancel without penalties.

BASIC PACKAGE:

$450.00 yr/$43.51 Month

Get your license and get to work.

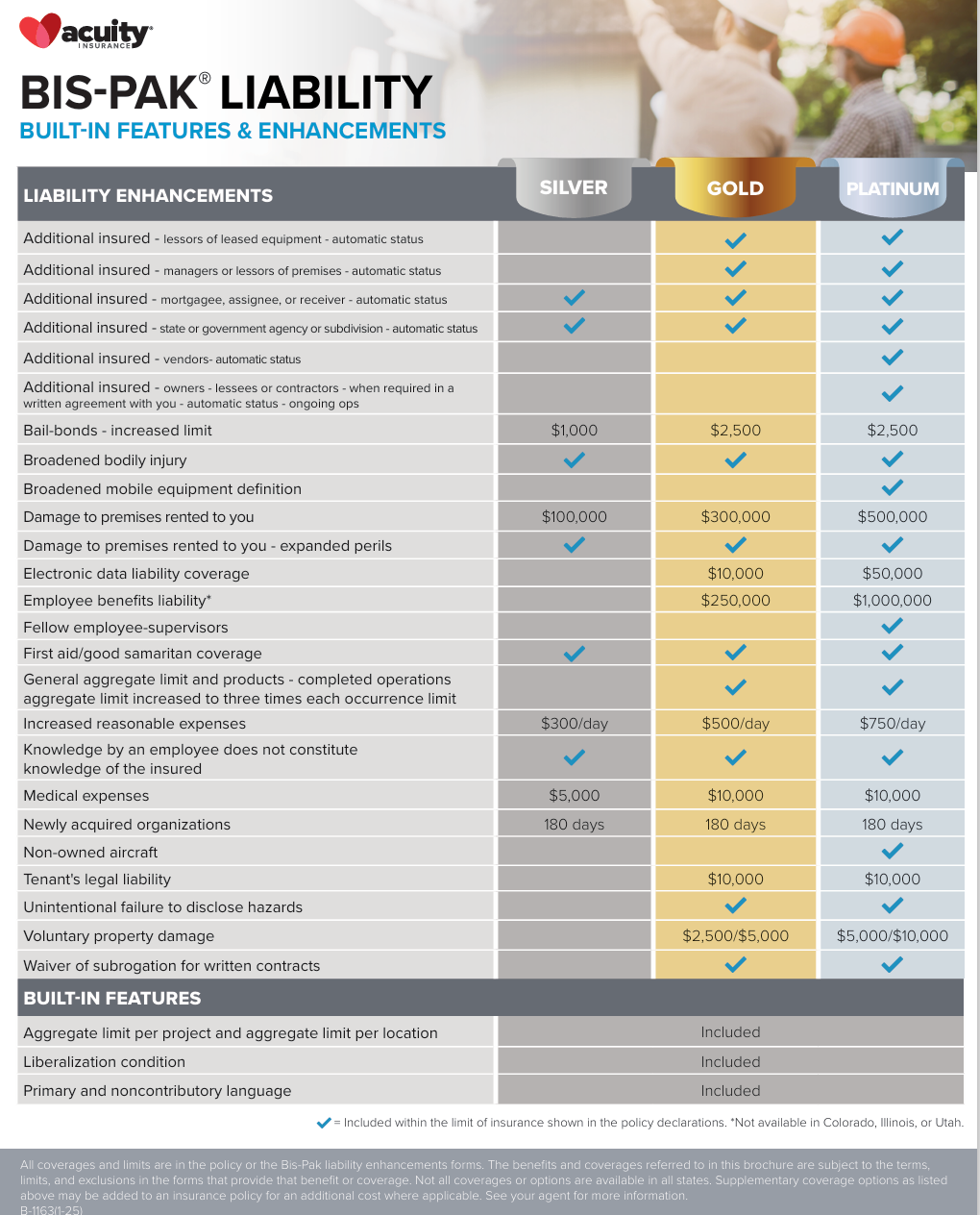

Silver Enhancements

GOLD PACKAGE:

$575.00 yr/54.91 Month

Most Popular: Certificates/Tools/High Limits

Gold Enhancements

*** Estimated pricing varies based on location, number of employees, and claims history.

Anderson Insurance Group offers window cleaning business insurance coverage through: Acuity Insurance, Auto-Owners, Cincinnati Insurance, WCF and United Insurance Group.

Core Coverages for Window Washing Contractors

General Liability Insurance

This is the foundation of your protection plan. It covers you if a third party suffers bodily injury or property damage while you’re working. Imagine a client tripping over a hose, or a ladder damaging a window frame—general liability takes care of the repair costs, medical bills, and any legal defense fees. In Utah, most property managers won’t allow work on-site without proof of this coverage.

Equipment & Tools Coverage

Tools & Equipment insurance reimburses you if valuable items are stolen from a job site, damaged in a vehicle accident, or lost in a fire. Whether you operate a mobile window cleaning service across Salt Lake County or service large commercial buildings in Provo or Ogden, this coverage ensures you can replace critical gear quickly and keep working without costly downtime.

Voluntary Property Damage

Even careful professionals can have accidents. If you crack a windowpane, scratch decorative glass, or damage a wooden frame, this coverage steps in where general liability stops. It pays for repairs or replacement and helps maintain your reputation with high-end clients who expect nothing less than perfection. What is Voluntary Property Damage Coverage? | Anderson Insurance Group

Contractors Errors & Omissions

This coverage protects you if a client claims your service was incomplete or performed incorrectly. For example, if streaks or residue cause a dispute or you miss scheduled windows for a commercial property and the client alleges financial loss, E&O helps cover legal defense, settlements, and related costs. It’s an extra layer of protection for Utah window cleaning businesses that service high-value or corporate accounts. What is Contractor's Errors & Omissions Insurance | Anderson Insurance Group

Workers’ Compensation

If an employee suffers an injury from a fall, strain, or chemical exposure, workers’ compensation insurance covers their medical bills, rehabilitation, and lost wages. This policy also shields your business from lawsuits related to workplace injuries. In Utah, carrying workers’ comp isn’t just smart—it’s legally required for businesses with employees. Work Comp Waiver in Utah | Anderson Insurance Group

Commercial Auto Insurance

Covers your van or commercial vehicle that transports equipment, ladders, and cleaning supplies. Commercial auto insurance protects company vehicles and drivers against collisions, theft, vandalism, and liability claims.

Why Choose Anderson Insurance Group

Why Your Utah Window Cleaning Business Needs Insurance

Licensing & Contract Compliance: Many commercial building owners and property managers require proof of liability and workers’ compensation insurance before allowing window cleaning work—especially for multi-story or high-rise jobs.

Protecting Your Finances: One accident can have devastating financial consequences. A single broken pane, equipment theft, or injury can cost thousands. Insurance helps you recover quickly and keeps your business stable.