Custom Roofing Contractor Insurance Utah

Safeguard your roofing company’s operations with customized, high-quality insurance coverage designed specifically for contractors in Utah.

Coverage Roofers Need

As a roofing contractor, you work high above some of your clients’ most valuable investments—their homes and businesses. From slip-and-fall risks to property damage caused during installation or repairs, roofing involves unique hazards. Ensure your business is fully shielded with a customized roofing contractor insurance plan from Anderson Insurance Group—your trusted partner for contractor coverage in Utah.

Commercial Auto

Contractors’ E&O - Errors and Omissions Insurance

Tools and Equipment

General Liability

Workers' Compensation

You can save up to 25% in discounts on Roofers insurance

You can pay for your insurance monthly or annually and you can cancel instantly at any time.

BASIC PACKAGE:

Get your license and get to work.

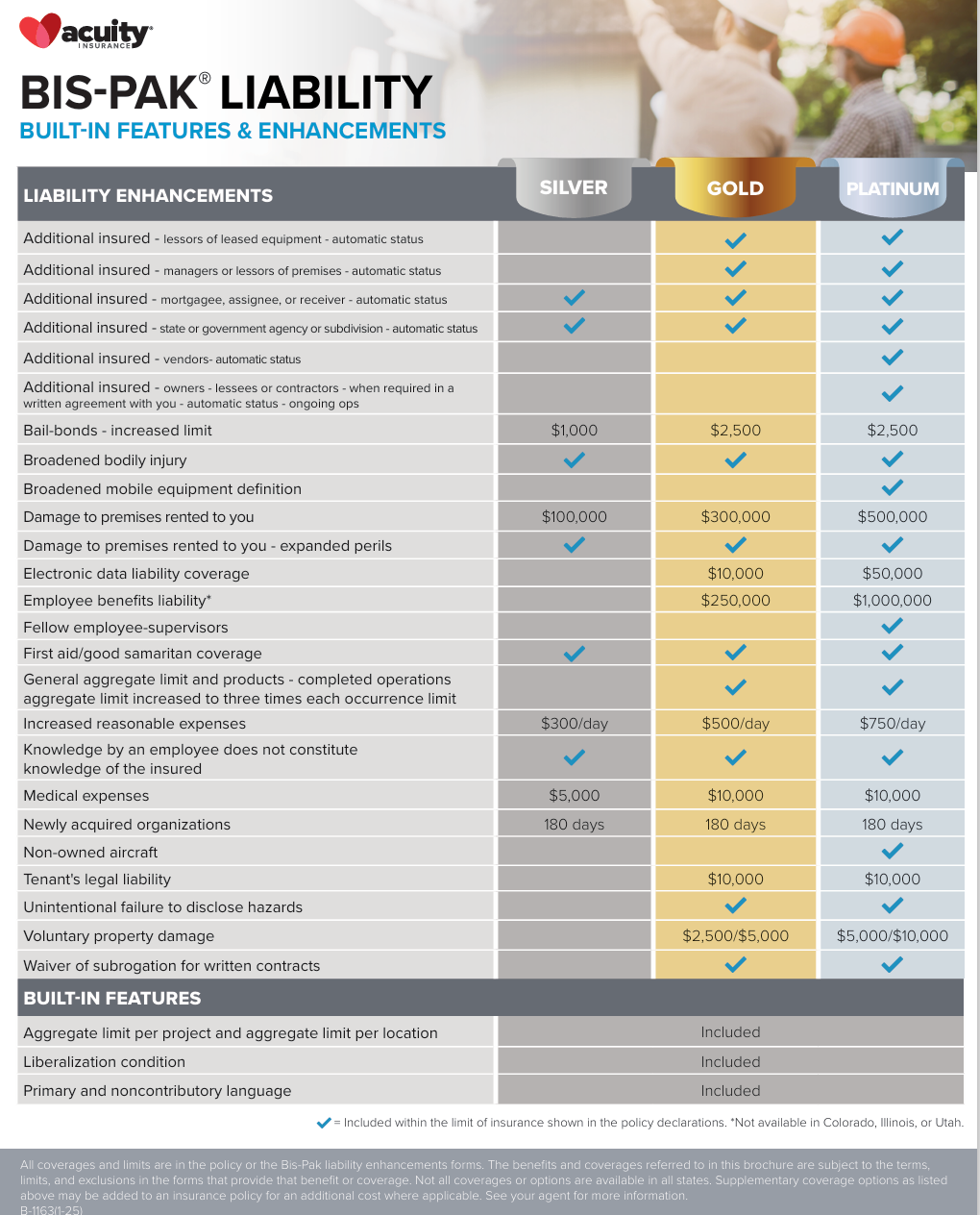

Silver Enhancements

GOLD PACKAGE:

Our most popular plan—ideal for contractors needing certificates, comprehensive tools coverage, and higher liability limits.

Gold Enhancements

PLATINUM PACKAGE:

Certificates/Tools/High Limits

Platinum Enhancements

Anderson Insurance Group offers Roofers Insurance Coverage through: Acuity Insurance, Auto-Owners, Cincinnati Insurance, and United Insurance Group.

Core Coverages for Roofing Contractors

Commercial Auto Insurance

If your roofing business involves transporting tools and equipment to job sites, commercial auto insurance is a must. This coverage protects your vehicles and drivers in case of accidents, theft, or damage, ensuring your business can continue operating smoothly. Commercial Auto Insurance | Anderson Insurance Group

General Liability Insurance for Roofers

This essential coverage protects your business from accidents and property damage that may occur on the job. Whether it's an injury to a client, third party or damage to their property, general liability insurance helps protect your company from financial loss and legal action.

Errors & Omissions (E&O)

Protects your roofing business from claims of professional mistakes or negligence, covering legal costs and settlements. Ideal for avoiding costly disputes and safeguarding your reputation. What is Contractor's Errors & Omissions Insurance | Anderson Insurance Group

More coverage beyond GL: E&O protects against mistakes such as improper installation or leakage claims later on.

Workers' Compensation

Workers’ compensation provides essential protection by covering medical expenses, rehabilitation costs, and lost wages if your employees suffer injuries while performing roofing work. Work comp for roofers assures your clients that if an injury occures on their premises, your coverage will respond. Workers’ Compensation | Anderson Insurance Group

Tools & Equipment Insurance

Ensure your valuable roofing tools—such as nail guns, compressors, safety harnesses, and cutting machines—are protected wherever your business takes you. From on-site accidents to theft while transporting tools, our insurance ensures your gear is protected so you can focus on the job at hand without worry.

Why Roofing Contractor Insurance Matters

Licensing & Contracts: Many Utah municipalities or commercial clients require proof of general liability and workers’ compensation before awarding roofing contracts.

Client Expectations: Customers expect coverage that protects them against property damage or injuries during roofing operations.

Financial Security: Roofing projects involve substantial risks—one serious accident or costly claim without adequate coverage could create overwhelming out-of-pocket expenses and jeopardize your entire business.