Auto and home insurance is right in the middle of a “hard market.” If insurance were Wall Street, this would be the Great Depression, most of us have never seen anything like it.

A June 2023 report from the American Property Casualty Insurance Association Home | APCIA sheds some light on the trends and reasons for the largest auto insurance rate increases in decades. Here are a few highlights and a link to the report. AutoInsuranceUncertainRoadAhead_JUN2023.pdf

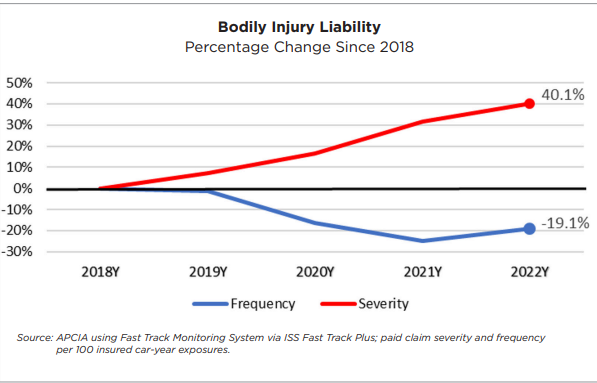

There are two primary factors that will cause insurance rates to go up, severity (the amount of the claim) and frequency (the number of claims)

FREQUENCY: Miles driven have actually dropped but the cost per claim – SEVERITY – for property damage and collision has increased 50% from 2018 to 2022. The four primary severity factors are auto body parts, labor costs, inflation and theft rates.

Auto Body Parts and prices are up 4.5% over the last 12 months and 24% since 2019 in an analysis published by CollisionWeek. Those increases are driven by higher used car prices that set the upper limit of repairs before a car is declared a total loss. While used car prices have come down from their record high of a year ago, they are still 39.5% higher than in 2019. Let that sink in, when an insurance company totals a car, they now pay 40% more than they did just four years ago. Due to the complexity of the repairs and lack of the availability of parts, cars are declared a total loss much more frequently than before. Those in our office who have not shopped for a new car lately about fall off our chairs when we see some of the total loss payments in 2023.

Labor Costs have increased with the complexity of cars. There is a new need for specialized labor, technicians who can work with all of the sensors and new car technology. It also requires more man hours to work on today’s sophisticated automobiles. Utah’s tight labor market have not made it any easier for body shops to find skilled labor.

Average Car Rental Times have increased dramatically to an average 18.7 days, some repairs take several months. Back in the good old days, you could drop your car off on Monday, pick up your rental, drop it off Friday when your car was ready having used 4-5 days rental car coverage at $20.00 per day. That does not happen anymore.

Auto Theft Rates continue to skyrocket. Have you heard the latest news about the Hyundai and Kia car thefts? Due to a crucial design flaw combined with a social media craze on Tik Tok you can’t even insure a Hyundai or Kia made during about 2010 and 2020 without proof the factory recall is done. Rappers have composed dozens of melodies about stealing your Kia with millions of downloads. The car thefts have increased so much that cities have sued the companies for the additional personnel required to file all the reports and process all the cars. This has not been a big problem in Utah – yet – but auto thefts are up nationwide and it all creeps back to our safer cities. We won’t even mention catalytic converter theft, if you drive a truck with a high exposure to catalytic converter theft, you already know.

LEGAL SYSTEM ABUSE: Our cars are safer and the price of gas is up. This has caused a reduction in driving and frequency of bodily injury claims of an encouraging 19.1%. Severity however, of bodily injury claims has increased 40.1% during the same 2018 – 2022 time period.

In analyzing the legal system abuse, the number of bodily injury lawsuits are down but the settlements are drastically increasing. Insurance trends always seem to start in two places, Florida and California. What follows is a creeping of the trend eventually making its way to Utah. Fortunately, we are normally one of the last states to feel the effects, but we feel them nevertheless. Just like we follow insurance trends from other states you can be guaranteed your favorite Utah personal injury attorney is watching these trends and can’t wait for them to get here. The unfortunate part is, they bring a lot of insurance rate increases and industry challengers with them.

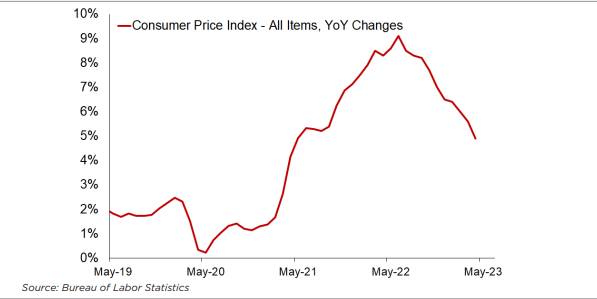

INFLATIONARY TRENDS: Insurance Claims Inflation has far outpaced the underlying consumer price index. The graph below shows the drastic year over year increase:

Insurance losses in 2022 were $25.6 billion, double those of 2021 and the worst result since 2011. So while it’s easy to blame increasing rates on inflation, insurance inflation is more complicated and is even outpacing inflation.

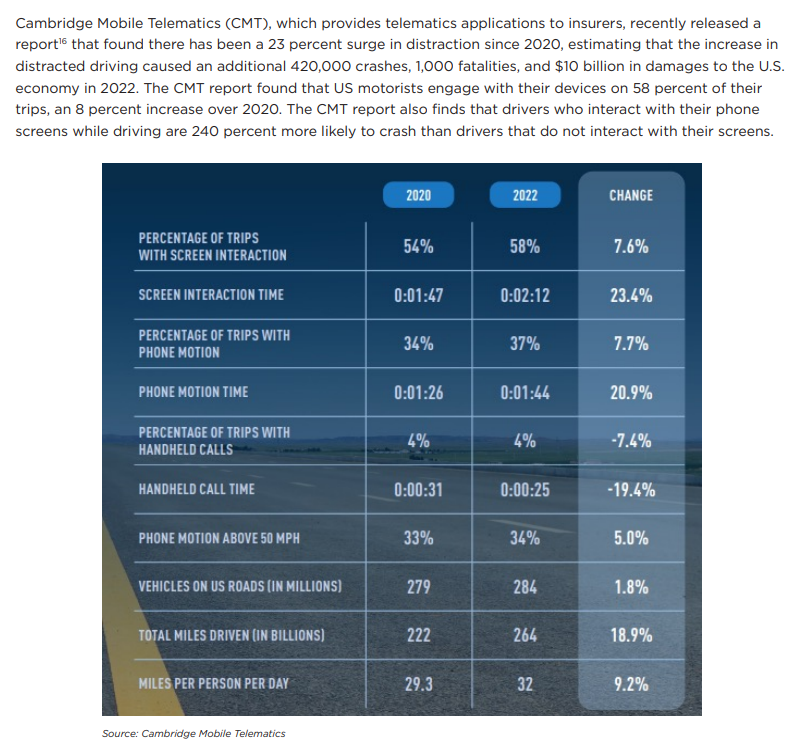

So what can we do? Trends say we need to slow down but most importantly, put away our phones. Cambridge Mobile Telematics who provides telematics applications to insurance companies recent released a report showing a 23% increase in distraction since 2020. Drivers who interact with their phones are 240% more likely to have an accident than those who don’t.

So what can we do? Higher deductibles will help save money on your premium and keep your frequency lower. Pay your premium in full every six months. Slow down and don’t drive distracted perhaps are most important. Buy a conservative car with available replacement parts. And call us, talk to your agent about your options. At Anderson Insurance Group we represent many different companies to be able to look for the best balance of price and coverage.

Anderson Insurance Group – Salt Lake City Utah – 801-262-1551

Article Links:

AutoInsuranceUncertainRoadAhead_JUN2023.pdf

Crash Course 2023 | CCC Intelligent Solutions (cccis.com)

The Kia Boys will steal your car for clout – The Verge

Cambridge Mobile Telematics – The world leader in telematics (cmtelematics.com)